ipIndex® USA is a full-market benchmark designed to measure and track the aggregate intellectual-property-driven value embedded in the U.S. stock market.

The index captures system-wide IP intensity, expressed as a percentage of total U.S. equity market capitalization, across 100% of NYSE- and NASDAQ-listed companies.

Unlike narrow IP or patent-focused indices, ipIndex® USA provides a macro-level, continuously observable measure of how much of the U.S. equity market’s value is attributable to intellectual property and intangible assets.

Conceptual Scope

ipIndex® USA tracks aggregate IP intensity ranging from approximately 25% to 90%+ per company, depending on sector and business model.

Crucially, the index can rise even when aggregate equity prices stagnate, reflecting structural shifts toward IP-dominant value creation rather than nominal stock price appreciation.

This creates a natural macro benchmark for the expanding role of intellectual property in modern capital markets and a strategic complement to ipShares® instruments.

Index Definition

ipIndex® USA is defined as the market-capitalization-weighted average IP intensity across the entire U.S. equity market:

[{ipIndex® USA} = \sum (w_i \times IP_i)]

Where:

- wᵢ = market capitalization weight of each listed equity

- IPᵢ = market-implied share of IP-driven value

IP intensity estimates are derived from public, non-proprietary information, including:

- market-based signals (ipShares® pricing where available),

- independent valuation studies (e.g., Ocean Tomo, Brand Finance),

- public disclosures and sector-level analysis.

The index relies exclusively on public data sources and is updated daily via automated data pipelines.

Market Interpretation

ipIndex® USA measures market-implied IP value, not accounting goodwill or administrative valuations.

Interpretation—including:

- absolute IP share,

- relative sector intensity,

- long-term convergence toward higher IP dominance—

is intentionally left to market participants, analysts, and institutional users.

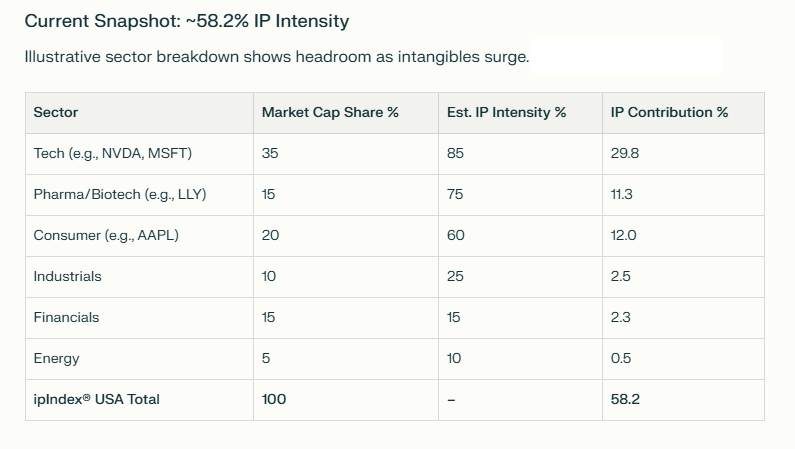

Current Market Snapshot (Illustrative)

Estimated Aggregate IP Intensity: ~58.2%

This level highlights substantial structural headroom as intangible assets continue to dominate value creation across the U.S. economy.

Extensions & ipShares® Integration

- Sub-indices:

- ipIndex® Tech USA

- ipIndex® Sector Series

- Derivatives Layer:

- ipIndex® futures and perpetual contracts for macro IP exposure

- Basis and relative-value strategies vs. single-name ipShares®

- Strategic Synergy:

ipIndex® provides the macro signal, while ipShares® deliver micro-level price discovery, jointly establishing IP as a fully tradable asset class.

Infrastructure & Compliance

- 100% public data

- Rule-based methodology

- Exchange-compatible margining (SPAN / VaR)

- Tokenized or traditional implementation

ipIndex® USA is launch-ready as a benchmark index and derivatives reference for the ipShares® ecosystem.

Victor Michelle

Co-Author & Co-Creator

ipStock™ | ipBonds® & ipShares®

CEO | Eurasian Stock Exchange

WIPO eTISC Expert

victor.michelle.post@gmail.com

Telegram @ip_bonds | X @ip_bonds

Natalie Michelle | Emilie Michelle | Elias Michelle

January, 2026